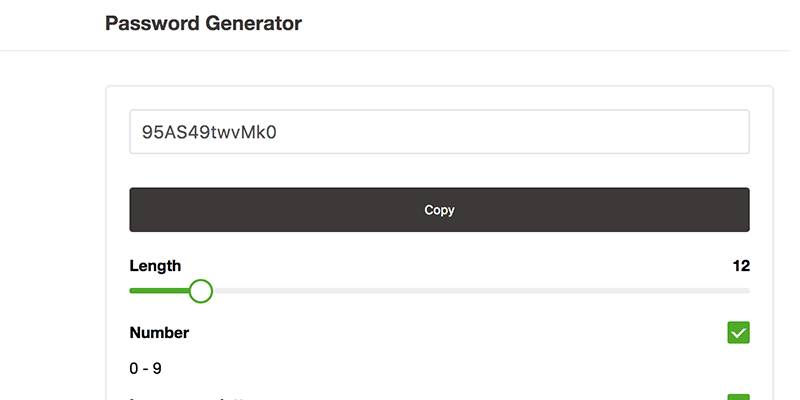

Such ex-post observation can result in a relatively high number of cases in which limits are exceeded, thus reducing the effectiveness of the limit stipulations.įigure Responsibilities in case of excess over limit Source: (Credit Approval Process and Credit Risk Management, 2005, Oesterreichische National bank) The limit utilization has to be documented in the credit risk report. The credit decision is taken based on the borrower’s credit standing and any collateral, but independently of the portfolio risk. After the credit approval based on the portfolio under review, and is not a component of the individual loan decision. In practice, this compliance is usually checked ex post, i.e. It needs to be determined if compliance with the limits should be examined before or after the credit decision is taken. This differentiation ensures that control signals are sent out not only after the (rigid) limits has been exceeded, but that early warning indicators point out the risk of exceeding a rigid limit in time to make sure that appropriate countermeasures can be taken immediately (Burns and Stanley, 2001) Limit Monitoring and Procedures Used When Limits Are Exceeded The stipulated limits can have a direct impact on the credit approval. The proposal for a risk strategy thus worked out will be presented to the executive board, and following their approval, passed on to the supervisory board for their information. The sales units contribute their perspective concerning market requirements and the possible implementation of the risk strategy. The risk strategy in an operational sense should be prepared at least every year, with risk management and sales cooperating by balancing risk and sales strategies. Risk strategy is defined as - the definition of a general framework such as principles to be followed in dealing with risks and the design of processes as well as technical-organizational structures and - the definition of operational indicators such as core business, risk targets, and limits.

Risk Strategy A successful, bank-wide risk management requires the definition of a risk strategy which is derived from the bank’s business policy and its risk-bearing capacity. The reasons behind managing credit risks are as follows (Amitabh Bhargava,2004): a) Increase shareholder value - Value creation - Value preservation - Capital optimization b) Instill confidence in the market place c) Alleviate regulatory constraints and distortions thereof. It is called PRISM, an acronym for – P = Perspective R = Repayment I = Intention S = Safeguards M = Management Management, a PRISM component, centers on what the borrower is all about, including history and prospects. (Basel Committee on Banking Supervision, 2000) Source: (Credit Approval Process and Credit Risk Management, 2005, Oesterreichische National bank) PRISM Model of credit risk management PRISM model is a contemporary model used in the credit risk management in modern world. In addition, the effectiveness of the measures implemented in risk controlling is measured, and new impulses are generated if necessary. The most commonly used management tools include: - Risk-adjusted pricing of individual loan transactions - Setting of risk limits for individual positions or portfolios - Use of guarantees and credit insurance - Securitization of risks - Buying and selling of assets Monitoring Risk monitoring is used to check whether the risks actually incurred lie within the prescribed limits, thus ensuring an institution’s capacity to bear these risks. Planning and management Furthermore, risk management has the function of planning the bank’s overall risk position and actively managing the risks based on these plans. Credit Risk Management process includes Credit Investigation, Financial Analysis, Credit Assessment, Credit Approval, Documentation, Monitoring ( Follow up, Supervision and Control) and Credit Recovery procedures.

#Artha rin adalat ain 2003 bangladesh pdf to word full#

The purpose of credit risk management is to ensure that individuals taking the risk have full knowledge about it, the bank or financial institution is exposed to an approved risk limit, the risk related decisions are in line with the business strategies, the compensation for the risk is adequate and sufficient capital support is there to buffer the risks. It includes detection, measurement, matching mitigations, supervision and control of the credit risk exposure. Credit Risk Management process permits the banks to proactively manage loan portfolios in order to minimize losses and earn a satisfactory level of return for shareholders. Credit risk is considered as a critical factor that needs to be managed by the banks and financial institutions. In credit risk management banks use various methods such as credit limits, taking collateral, divers Dhaka ation, loan selling, syndicated loans, credit insurance, securitization and credit derivatives.

0 kommentar(er)

0 kommentar(er)